The major part of Indian economy still in the hands of lower and middle-class people. They use to keep their savings in the form of Fixed deposits in the Banks, the most trustable form of keeping your money and get back with interest. Once a year, everybody heard about Form 15G and 15H.

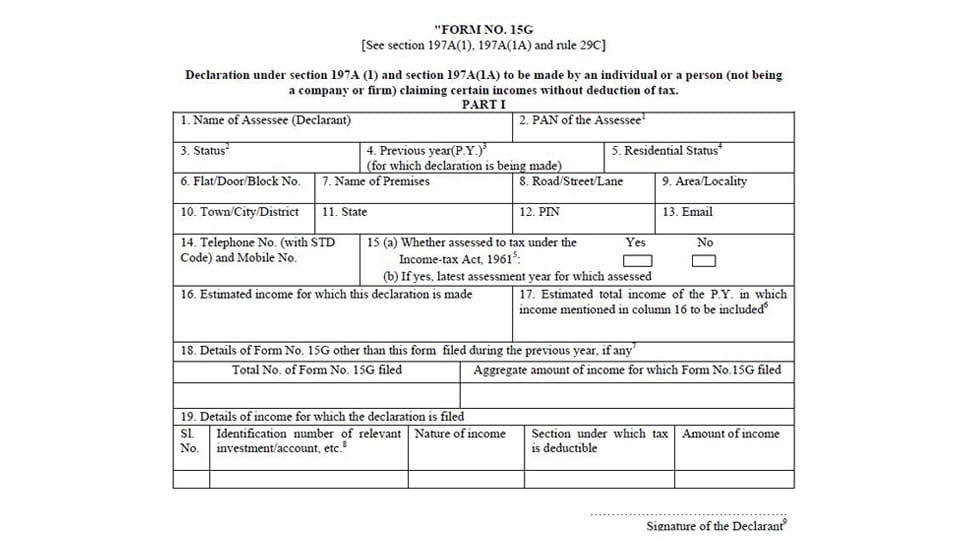

- Form 15G in Fillable Format. Form 15 G - Declaration under sub-sections (1) and (1A) of section 197A of the Income-Tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax.

- Recommended Read: Difference between form 15H and Form 15G The only major change in these forms, compared to the earlier versions, is the addition of a column to mention the total estimated income from all sources, including the income for which exemption from TDS is requested.

- Form 15G in Fillable Format. Form 15 G - Declaration under sub-sections (1) and (1A) of section 197A of the Income-Tax Act, 1961, to be made by an individual or a person (not being a company or a firm) claiming certain receipts without deduction of tax.

- New Form 15G & Form 15H: New format & submission procedure. If your total income is below the taxable limit, you can submit Form 15G and Form 15H to the bank or any deductor requesting them not to deduct any TDS on your interest. Form 15H is for senior citizens who are 60 years or older and Form 15G is for everybody else.

[See section 197A(1), 197A(1A) and rule 29C] PART I 7. Assessed in which Ward/Circle Declaration under section 197A(1) and section 197A(1A) of the Income‐tax Act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. Income Tax Forms 15H (15h) in fillable pdf and Excel Format - Form 15H / 15G for Interest Income for FY 2018-19 (AY 2019-20) of Bank / Post Office Deposits increased in tax exemption limit from Rs 10,000 to Rs 50,000.

In this article, you must diagnosis all about Form 15G and 15H, What is Form 15G & Form 15H, its importance, how it works, the relation between Form 15G Form 15H and income tax department? benefits of filing Form 15G & Form 15H, how to fill form 15g & form 15h and why to fill form 15G & form 15H.

Start with:

Also Read: Highlight key changes under ITR1 from FY 2018-19

What is Form 15G and 15H?

Before understanding form15G/15H, you must drive to the other hand of the story

If you possess a fixed deposit in the bank, you will get the interest from the bank, if the interest income exceeds ₹ 10000, the bank will deduct TDS @ 10%, if the PAN details are not deposited the TDS @20% will be deducted.

Now, the role of form15G/15H comes into play, if you submit Form 15G and 15H to the bank, you will avoid deduction of TDS from your interest.

Also Read: Tax liability on Car Allowances 2018

On can submit this form in banks, post offices or a company for avoiding TDS deduction.

Form 15G is required to fill for the Indian resident below 60 years of age.

Form 15H is required to fill for the Indian resident above 60 years of age.

The condition of filing Form 15G

Form 15G is a kind of undertaking submitted to the banks or financial institutes which reveals that:

- The interest income received for the banks is during the financial year is should not exceed the slab of 2.5 in FY 2017-2018.

- The income along with interest on estimated income as per tax department in NIL.

Although as per income tax norms any payment made to the individual as interest on securities or fixed deposits must be deducted with TDS.

Also Read: What is Form 26AS (How does it work filling IT return)

A lot of people holding of fixed deposits does not lie in income tax slab, that’s why they submit Form 15G/H as undertaking to the bank and the bank will make the payment without deducting the TDS.

Sometimes, if your interest income is calculated above tax exemption slab, then there is no use of submission of Form G&H.

You must opt for refund channel by filling income tax return.

The condition of filing Form 15H

Form 15H is as same as Form 15G, the only difference is Form H is filed by the individual above the age 60. rest all the conditions are same as Form G.

Also read: Fill Income tax return ITR1 in 5 Minutes: The Complete Guide

What happens if you miss filing FormG or FormH

There are two scenarios under this head:

- If you are a taxpayer and fails under tax slab, the TDS deducted by the bank will be mentioned in the Form 16A or TDS certificate and that would be adjusted while filing income tax return and you have to pay tax after deduction of the TDS amount.

- If you are not supposed to pay tax or you are not in tax slab, the tax deducted by the bank would be refunded when you file an income tax return.

When should you submit Form 15G Form 15H

Download Form 15g In Pdf Format

It is recommended to submit the form in the starting of the financial year so that the bank will not deduct your TDS from your interest income. If it was submitted after deducting of TDS in the bank, the only way to refund your TDS is by filing the income tax return.

Don’t forget the take acknowledgment from the bank after submitting the form.

From where you get Form G & H

Form 15g In Pdf Format

You can get Form H & Form G from income tax website https://www.incometaxindia.gov.in/pages/downloads/most-used-forms.aspx

Click here to get Form H & Form G directly in PDF format.

Also Read: Understand Tax saving options : (80C deduction Guide)